Identifying the appropriate average retirement income in America is essential. The average retirement income is the lowest to the highest. Unfortunately, it’s the middle number.

There are specific questions to prepare for your next phase. For example, do I have enough to fund my dream retirement? Do I have enough to cover my expenses?

But, if you’re close to retirement age, there are some things you should look out for. One is researching the average retirement income rate for the past two years. According to economic experts, the rate of retirement income has declined since 2019 till date. As a result, the government is afraid that even the average family might be unable to survive on retirement income.

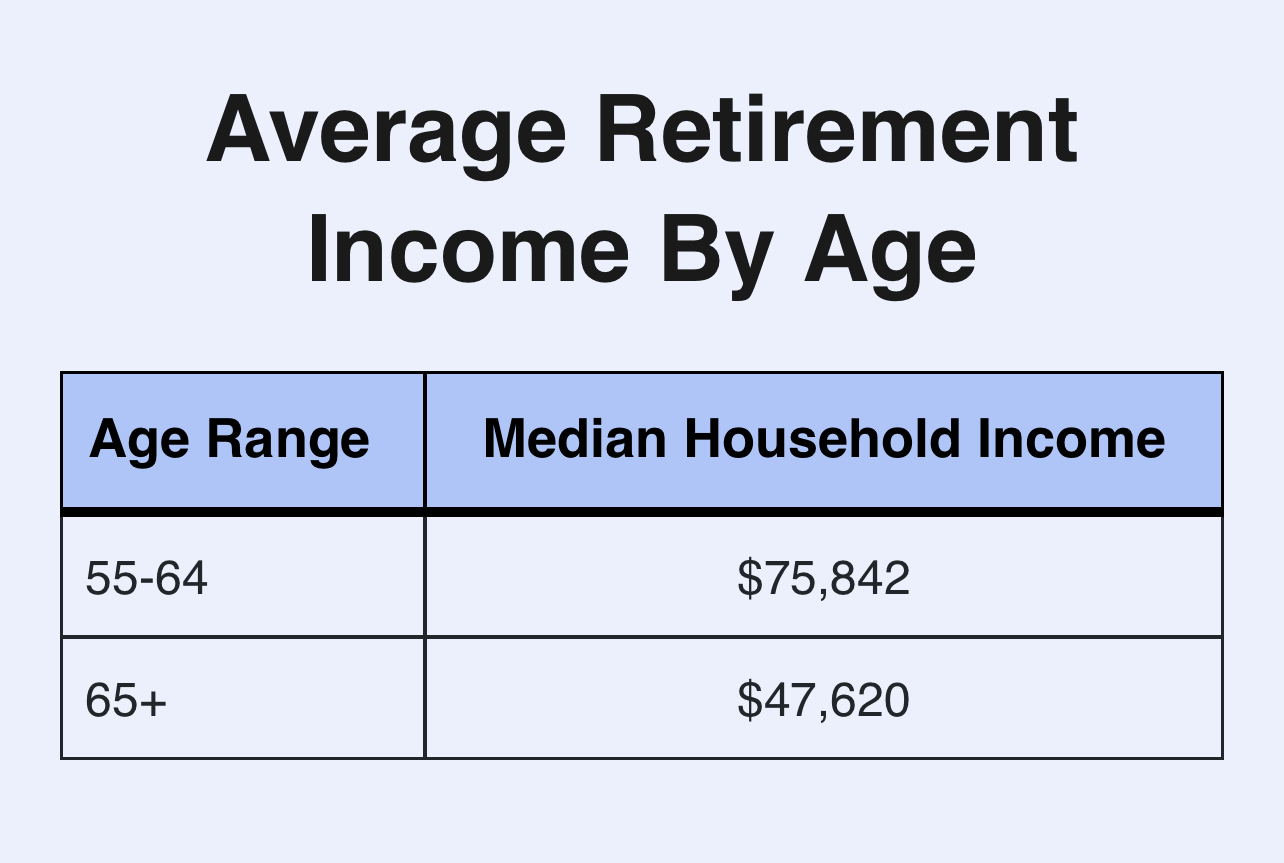

In 2021, the average retirement income was $65,000 in the mid-2000s. Considering that cost of living has sporadically increased, Americans are saving more aggressively than before. Since 1989, the retirement rate among Americans has increased every three years, with a few exceptions due to economic instability. According to the Federal Reserve, the average retirement income for retirees 65 years and older will be $47,625 in 2021.

However, in 2022, there has been a significant improvement in saving rates among Americans. In addition, the Federal Reserve notes that people are getting more conscious after the pandemic. Though people are beginning to save more, there has since been a drop in the average retirement income among people 65 and older.

Nowadays, retirement is a mindset rather than a physical hibernation from work. The rich are getting richer, which makes the average household appear on the borderline. With the prevalent layoffs, there has since been a decline in the quality of living. The poor have to hang on to whatever they can. The median income is currently at $46,350 in 2022.

What Is A Good Monthly Retirement Income?

An excellent monthly retirement income should be 80% of your pre-retirement income. Therefore, before retiring, you should have saved up about 80% annually of your income. For example, if you receive $50,000 annually from your job, you should receive approximately $4,100 monthly retirement income.

A significant consideration is how you plan to live your retirement years. For example, do you wish to acquire skills and have a side hustle? On the other hand, do you want to live a rustic lifestyle?

“Retirement savings and perceived preparedness differed across demographic groups. Younger adults were less likely to have retirement savings and to view their savings as on track than older adults. Compared with all non-retirees, Black and Hispanic non-retirees were less likely to have retirement savings and to view their retirement savings as on the track, while White and Asian non-retirees were more likely to have such savings and say they were on track.” mentioned by the federal reserve.

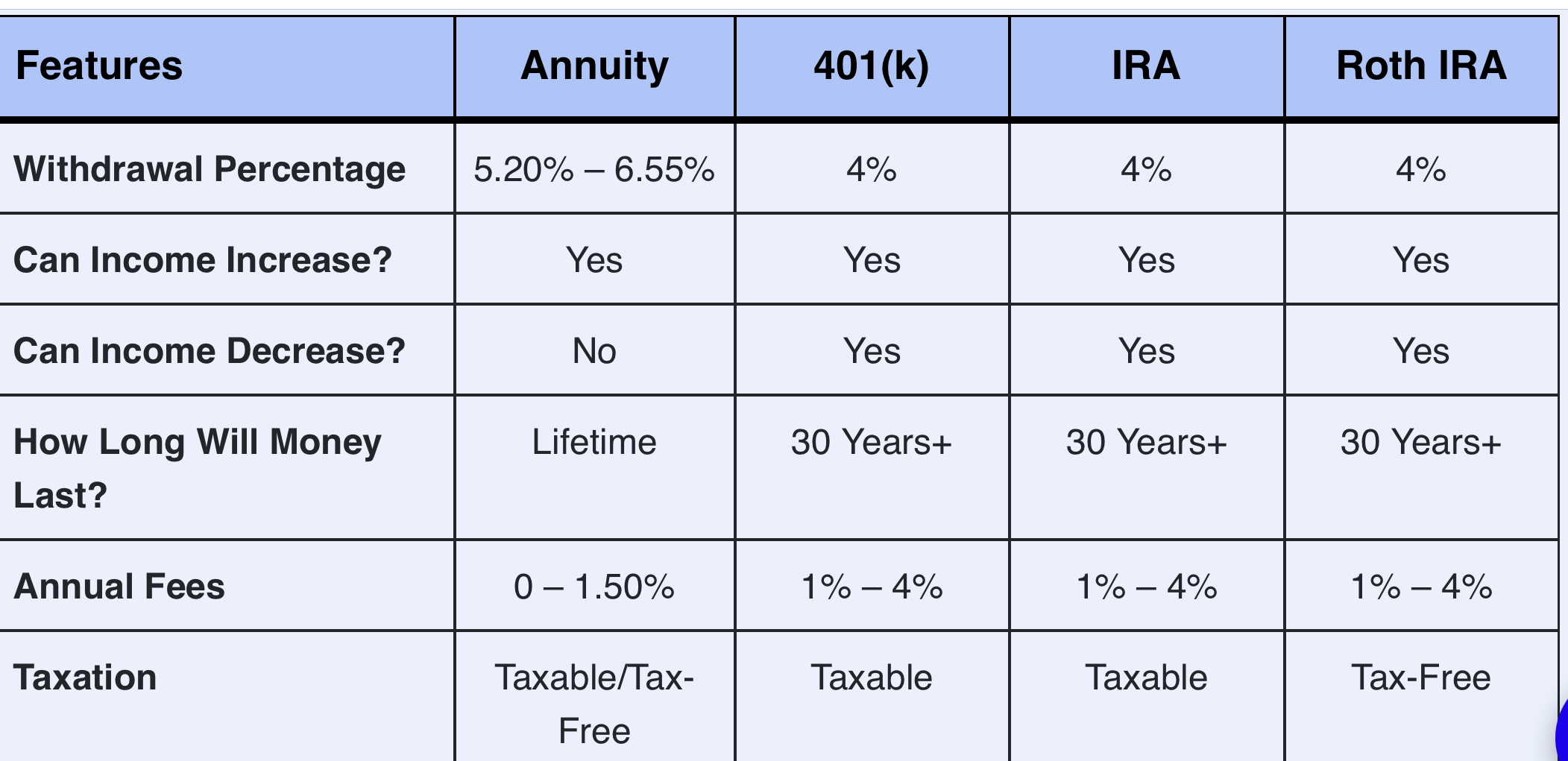

Like the 80% rule, you can save 80% of your salary and still earn a substantial amount in retirement. You wouldn’t have to depend on social security and take odd jobs. According to reports, the average retiree household older than 65 years old earns less than $40,000 annually. The figures are worse for single mothers aged 60 and above. We can see that the median retirement income might not be as healthy as people think. As such, you must become studious with saving and investment before you say goodbye to your office. The table below compares the average income that can be withdrawn from investment accounts safely regardless of retirement age.

Another rule of thumb is the 25X saving of pre-retirement income. This rule believes you should have 25X your pre-retirement income in your retirement salary. A monthly retirement income depends on an individual and how their living expenses vary from person to person. From the Federal reserves data, the cost of living is high. It has also recorded a high “working retirement” among people who retired early.

Tips To Help Save For Retirement At Any Age

Saving for retirement is tricky because you’re unsure how the next few years will unfold. Most soon-to-be retirees begin to evaluate and check their medical histories at a later date. They start saving when they have a year or two to go. Below are curated tips to help you save for retirement at any age:

- Start saving today.

One thing that may need to improve in retirement is your savings history. Savings go a long way from stashing cash in your account. Instead, it prepares you for your 401k when you’re finally eligible. In addition, people in their early 20s are advised to save 1x their salaries as they have substantial student loans to pay off in the coming years.

People in their 30s have mortgages and student loans to pay off. In your 50s, save 3x your annual salary. You should have paid off your student loan. By age 60, you have saved 5 – 8X your yearly salary. An excellent saving habit prepares you for the long run.

- Save in your 401k.

If you don’t own a 401k account yet, you should probably get one before it’s too late. That is if you’re eligible. A 401k account allows you to save up on your pre-tax income. It contributes immensely to your social security income during retirement. You can also acquire a Roth 401k account. A Roth 401k utilizes your income after your tax has been deducted. However, before taking on a Roth 401K account, consider what your income tax bracket will look like in retirement.

- Open an Individual Retirement Account

An ira is an account where you can save your monthly income and withdraw during retirement. An ira is for self-employed individuals who don’t have access to the traditional workplace 401k accounts issued by an employer. As such, ira has tax advantage benefits. For example, tax in a conventional ira account may be tax deferred. Tax-deferred means you will be taxed at a lower rate once you start withdrawing during retirement. If the traditional ira doesn’t suit you, you may opt for a Roth ira.

A Roth ira is similar to the traditional ira, except that you make monthly contributions of already taxed income. Many prefer this account because you can make tax-free withdrawals, and your money grows without impediments. Another type of individual retirement account is the rollover account. It means an asset or income you have transferred from an employee-based sponsored plan. Such plans include 401k 0r a 403b accounts.

- Catch-up Contributions

An ira account has limits. So you can’t contribute all your savings to it, which is a disadvantage. However, you can always utilize the catch-up contributions if you’re 50 and above. Once you’re 50 and above, you’re automatically eligible to save beyond your limits. So don’t worry if you can’t reach your current limit. You can always utilize this option.

- Delay social security

Maximizing your options and profits will benefit you in the long run. Once you’re 65 years old in retirement, you’ll begin to be paid social security income. However, most people don’t realize that your monthly payment will increase by delaying your social security income. Waiting for your retirement age helps you add up this monthly income. You may hinder your retirement by a year, two, or five years depending on how much you envision during your retirement years.

Retirement Calculator

Everyone should begin to calculate what their retirement income should look like. Then, from your early or mid-20s, you should start strategizing ways to have a fulfilling retirement. According to the reports by the federal reserve, the younger generation hopes to retire before 50 or 60. This could be due to several more entrepreneurial opportunities than the older generation.

A retirement calculator doesn’t have an age limit. If you’re in your 20’s, 50’s, or late 60’s, you can always use a retirement calculator. You can use our calculator if you don’t know where to calculate your retirement income. It’s straight to the point. You have to input your age and current monthly payment, and you’ll have a sum of your proposed retirement income.

Iras And Your Retirement Savings

As stated earlier, an individual retirement calculator is a retirement saving account generally meant for individuals who aren’t accorded the traditional 401k or 403b retirement account. An individual retirement account also comes with its benefits when saving for retirement. For example, it’s tax-deferred and guarantees your income steadily increases tax-free over the years. Unfortunately, most people are confused and use both retirement accounts interchangeably.

A retirement saving is a traditional 401k account issued by your employer. Your employer automatically opens a retirement saving account for saving your monthly income. As an employee, a special payment allocation is automatically contributed to your 401k account.

An ira offers more investment choices when compared to a traditional 401k account. Some people also own a conventional 401k account and an individual retirement account. Both have tax advantages, and your earnings aren’t altered in any way. The significant difference between a traditional retirement account and an individual retirement account is income distribution. Some Iras tax your income during retirement, while some are tax-free in interest and earnings.

A significant similarity between both accounts is that they have an age limit before you make withdrawals. You must be 591/2 years of age. However, if you withdraw before you clock this age, the internal revenue service will levy a tax penalty on you. There are quite a few cases of exceptions to early withdrawals. This case depends on the type of retirement account and the amount in such an account.

Retirement Age Calculator

A retirement age calculator guides you on how much you need to save before your preferred retirement age. A retirement age calculator enables you to plan your investments and savings wisely before your retirement sets in. Of course, everyone can retire at any age as they please. Although what most people are keen on is the benefits that come with retiring at a certain age.

For example, they are withdrawing money from your retirement account before 60. The internal revenue service has a policy that enables employees to withdraw from their retirement accounts at age 55 without debt. A key difference between some is that your retirement age and legal age differ; both periods come with different benefits.

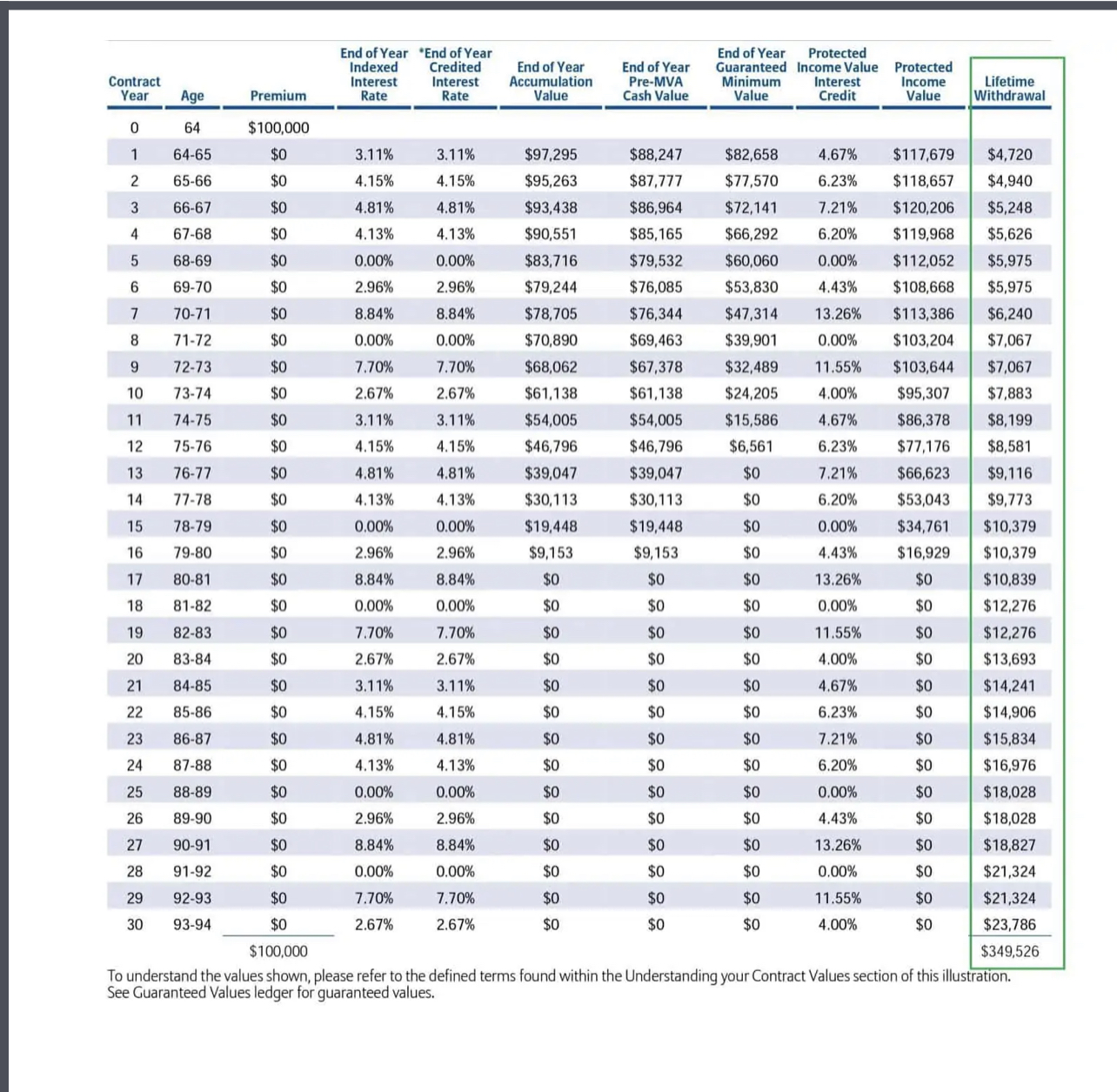

Retiring earlier than the approved government age can mean you deferred some benefits. For example, if you quit before the age of 65, it means your social security benefits will reduce by up to 30%. People who cross the eligible retirement age of 65 have access to full social security benefits. The benefits gradually increase every birth year until age 67 or 70. Retiring at 70 is the prime of enjoying social security benefits. Currently retiring at 62 in 2022, sums up to $2,364. If your retirement age falls at 70, you want help from up to $4,194. Below is an example of a 64-year-old retiree who, with $100k, purchased an increasing income rider.

A retirement age calculator helps you prepare for retirement. It shows you the proposed retirement age based on your current age, retirement savings, monthly investments, and expected interest rates in a year. These details are imperative for any successful retiree. In addition, a retirement age calculator helps you estimate how much you’ll need in the long run. It also implores you to try other investment opportunities if your current investment isn’t yielding.

A retirement age calculator helps you prepare for retirement. It shows you the proposed retirement age based on your current age, retirement savings, monthly investments, and expected interest rates in a year. These details are imperative for any successful retiree. In addition, a retirement age calculator helps you estimate how much you’ll need in the long run. It also implores you to try other investment opportunities if your current investment isn’t yielding.

The social security benefit calculator also provides the projected benefits you need based on your date of birth or earning history. If you haven’t tried using a retirement age calculator, you should invest in one today and prepare for your retirement life. You can never go wrong with this information.

How Much Money You Need To Retire

One thing about retirement is you only see it incoming once it dawns on you. You usually think you have a substantial amount of years, so you delay savings and spend more. No one knows how much they need for retirement because lifestyle and individual preferences matter. What works for household A might not work for household B. This is why you need to account for every penny you save pre-retirement.

Studies have shown that most American families rely on social security benefits during retirement. However, as of 2022, more than social security benefits may be needed to sustain a household. In addition, due to economic turmoil, saving aggressively during hard times is vital.

A monthly retirement income of $5,000 may seem enough, but individuals differ. If you plan to cruise during your retirement, that amount might be the tip of the iceberg for you. You’ll probably need more money to survive your dream retirement life.

However, if you don’t have that amount and want to live comfortably, you can start by cutting back on some lifestyle and habits like eating out frequently, attending concerts, etc. Replace all these by eating at home and learning new recipes. It saves you a lot of money. Selling your large home might be adequate when your kids are out of the nest. That way, you have an added income to your retirement savings. At least $5,000 should sustain you if you plan to live on your means and not go overboard.

There is no such thing as a specific amount to retire. Know what is good for you and stick by it. Of course, you may not have your preferred amount for various reasons, and that’s fine.

How To Maximize This Income

Planning for retirement has to be one of the most challenging responsibilities. You’re on the verge of various life crises like illness, debt, disability, etc. Once you start receiving your monthly retirement income, the challenge will be maximizing your revenue. The number one rule is to spend less and wisely. You can’t have enough and plan for a large cruise or buy new houses. It’s a plan for failure if you don’t have much. There are a few ways your income can appreciate during retirement. Such as:

- 4% Rule

The 4% rule is a strategy most people swear by. The rule states that you withdraw 4% of your income. However, due to current economic trends, it might not be a safe option anymore. Most people have debunked the 4% rule because it doesn’t fit everyone. Regardless, it’s still a great way to maximize your wealth.

- Delay social security benefits

As explained above, delaying this helps increase your income significantly when you reach age 70. Unfortunately, most people enjoy their benefits at this age but are primarily scared due to health risks that may prevent them from utilizing such funds.

- Get a part-time job

Most people get part-time jobs during retirement to supplement their monthly income. The freelance market is currently swamped with retirees looking for a means to earn extra income. So, it’s a great way to flex your muscles and add a new skill to your portfolio.

- Capital Gains Tax

The capital gains tax may favor you if you keep on being below certain maximum limits. For couples, their combined annual salaries may be $80,000 to acquire no capital tax. Always check your withdrawals and ensure they are below the limit to prevent incurring capital gains tax on your income.

- Spend wisely

Retirement is a rejuvenation period in everyone’s life. It would help if you spent less wisely. When you run out of cash, you must be mindful and alert of any situation, especially a medical emergency.

The post Average Retirement Income first appeared on American Bullion.Original post here: Average Retirement Income

No comments:

Post a Comment