Inflation is a measure of how much prices for goods and services have risen over time. It is usually measured by the Consumer Price Index (CPI), which tracks the cost of a basket of goods and services that a typical consumer would purchase. In recent months, inflation in the United States has risen significantly, leading to concerns about the economy’s health and its impact on consumers. This article will explore the causes of high inflation, the main drivers of this trend, and what can be done to stop it.

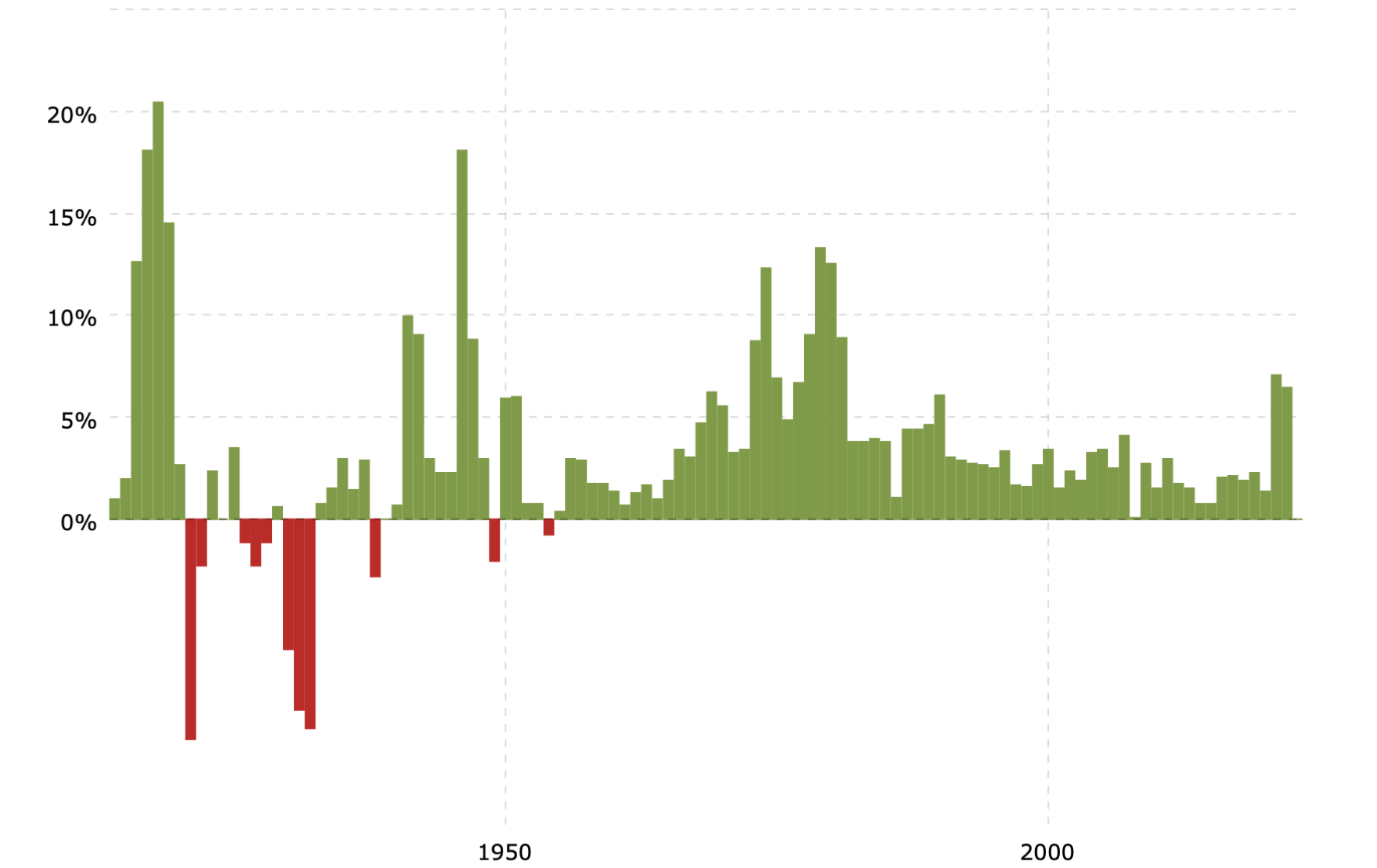

Historical Inflation Rate by Year

Interactive chart showing the annual rate of inflation in the United States as measured by the Consumer Price Index back to 1914. The current rate of U.S. CPI inflation as of January 2023 is 296.80.

Key Takeaways:

Key Takeaways:

- Inflation measures how much prices for goods and services have risen over time.

- In recent months, inflation in the United States has risen significantly, leading to concerns about the economy’s health and its impact on consumers.

- The causes of high inflation include supply chain disruptions, rising commodity prices, and monetary policy.

- The main drivers of high inflation are supply-side factors, such as supply chain disruptions and rising commodity prices, and demand-side factors, such as increased spending by consumers and businesses.

- To stop inflation, policymakers can use various tools, such as raising interest rates, tightening monetary policy, and implementing fiscal measures.

Causes of Inflation:

Several factors can contribute to high inflation, including supply chain disruptions, rising commodity prices, and monetary policy.

Supply Chain Disruptions: One of the leading causes of high inflation is supply chain disruptions. These disruptions can occur due to various factors, such as natural disasters, labor strikes, and pandemics. When disrupted, supply chains can lead to shortages of goods and services, which can drive up prices. For example, the pandemic of COVID-19 has caused supply chain disruptions and led to higher prices of goods and services.

Rising Commodity Prices: Another factor that can contribute to high inflation is rising commodity prices. Commodities are raw materials used to produce goods and services, such as oil, metals, and agricultural products. When the costs of these commodities rise, it can lead to higher prices for goods and services. Recently, oil, copper, and lumber commodities have been rising, contributing to inflation.

Monetary Policy: Monetary policy can also contribute to high inflation. Central banks use monetary policy to control inflation by adjusting interest rates and the money supply. When interest rates are low, it can lead to increased spending by consumers and businesses, which can drive up prices.

Main Drivers of High Inflation:

The main drivers of high inflation are supply-side factors, such as supply chain disruptions and rising commodity prices, and demand-side factors, such as increased spending by consumers and businesses.

Supply-Side Factors: Supply-side factors refer to factors that affect the supply of goods and services, such as supply chain disruptions and rising commodity prices. When supply is reduced, it can lead to higher prices.

Demand-Side Factors: Demand-side factors refer to factors that affect the demand for goods and services, such as increased spending by consumers and businesses. When demand is high, it can lead to higher prices as businesses respond to the increased demand by raising their prices.

In the current situation, supply-side factors such as supply chain disruptions and rising commodity prices have significantly driven up prices. The pandemic has caused disruptions in global supply chains, leading to shortages of specific goods and services and increasing costs. Additionally, the prices of commodities such as oil, copper, and lumber have been rising, contributing to inflation.

On the demand side, increased spending by consumers and businesses has also played a role in driving up prices. The government stimulus measures, such as increased unemployment benefits, have led to increased consumer spending, which has led to higher prices. Additionally, businesses have been raising prices to keep up with the rising costs of goods and services.

How Can Inflation Be Stopped?

To stop inflation, policymakers can use various tools, such as raising interest rates, tightening monetary policy, and implementing fiscal measures.

Raising Interest Rates: One way to stop inflation is to raise interest rates. When interest rates are higher, borrowing is more expensive, leading to less spending by consumers and businesses. This can help to slow down inflation.

Tightening Monetary Policy: Another way to stop inflation is to tighten monetary policy. This can be done by reducing the money supply or increasing banks’ reserve requirements. When the money supply is reduced, it can lead to less spending by consumers and businesses, which can help to slow down inflation.

Implementing Fiscal Measures: Fiscal measures can also be used to stop inflation, such as reducing government spending or increasing taxes. For example, when government spending is declined, it can lead to less spending by consumers and businesses, which can help to slow down inflation.

In conclusion, high inflation is a complex issue with multiple causes and drivers. Supply-side factors such as supply chain disruptions and rising commodity prices, as well as demand-side factors such as increased spending by consumers and businesses, have contributed to the recent rise in inflation. To stop inflation, policymakers can use various tools such as raising interest rates, tightening monetary policy, and implementing fiscal measures. Therefore, it is essential for policymakers to carefully monitor the situation and take action to address the causes of high inflation to maintain economic stability

Understanding how inflation can affect your taxes is crucial for making informed financial decisions. By keeping an eye on the new tax brackets each year, you can ensure that you’re paying only what you have to. One option to consider is a gold IRA if you’re interested in learning more about protecting your wealth from inflation and stock market volatility. A gold IRA is a type of individual retirement account that allows you to invest in physical gold, silver, and other precious metals.

Gold has historically been a hedge against inflation and has held its value over time. Including gold in your retirement portfolio can diversify your investments and potentially reduce your overall risk. American Bullion is a highly reputable company specializing in gold IRAs; we can guide you through the process and answer all your questions.

If you’re interested in learning more about gold IRAs and how they may fit into your overall financial plan, contact American Bullion today at 1-800-465-3472. We can provide the information and resources you need to make an informed decision about your future.

The post Why Is Inflation So High? first appeared on American Bullion.Original post here: Why Is Inflation So High?

No comments:

Post a Comment