Inflation is a common and persistent economic challenge, and it can significantly impact the stock market. The good news is that several stocks are well-positioned to weather inflationary pressures and provide solid returns for investors. In this article, we’ll look at inflation, how it affects stores and some of the best inflation protection stocks of 2023.

How Does Inflation Affect Stocks?

Inflation is a general rise in prices for goods and services over a while. When the cost of living goes up, a dollar’s purchasing power decreases, making it more difficult for consumers to buy what they need. This, in turn, can hurt the economy and lead to a decrease in the value of stocks.

The stock market is closely tied to the economy’s health, and inflation can be a significant factor in determining the economy’s health. The central bank may raise interest rates when inflation is high to cool the economy and curb inflation. This can make it more expensive for companies to borrow money and lead to a decrease in the value of stocks.

However, not all stocks are equally affected by inflation. Companies may be better positioned to weather inflationary pressures, particularly those in specific industries. For example, companies in the healthcare and technology sectors may be less affected by inflation, as these industries tend to have pricing power and are less sensitive to economic changes.

The Best Inflation Protection Stocks of 2023

So, which stocks are best positioned to protect against inflation in 2023? Here are ten stocks to consider:

Johnson & Johnson (JNJ)

Johnson & Johnson is a multinational healthcare company with a wide range of products and services. The company is well-positioned to weather inflationary pressures, as it has a strong brand and a reputation for quality and operates in a relatively stable and growing industry.

Procter & Gamble (PG)

Procter & Gamble is a consumer goods company that produces a wide range of products, including household goods, personal care products, and healthcare products. The company has a long history of stable earnings and is well-positioned to weather inflationary pressures, as it has pricing power and a large and growing customer base.

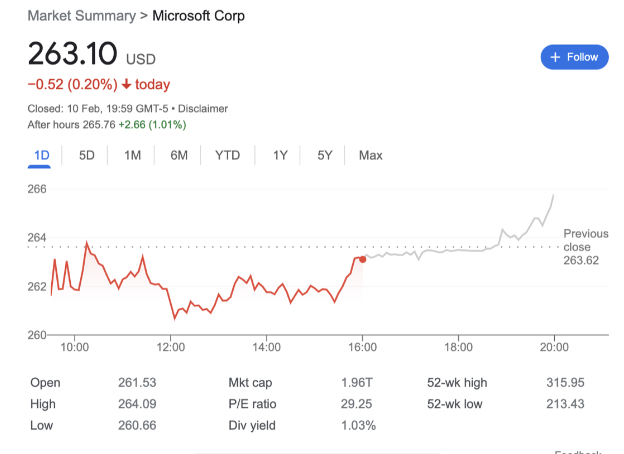

Microsoft (MSFT)

Microsoft (MSFT)

Microsoft is a technology company that produces a wide range of products and services, including software, hardware, and cloud services. The company has a strong brand and a large and growing customer base, and it is well-positioned to weather inflationary pressures, as the technology industry is relatively stable and has pricing power.

Walmart (WMT)

Walmart (WMT)

Walmart is a retail company that operates a large chain of discount stores and is one of the largest retailers in the world. The company is well-positioned to weather inflationary pressures, as it has a large and growing customer base and can pass on price increases to consumers.

Coca-Cola (KO)

Coca-Cola is a beverage company that produces a wide range of products, including soft drinks, juices, and water. The company has a strong brand and a large and growing customer base, and it is well-positioned to weather inflationary pressures, as it has pricing power and a relatively stable industry.

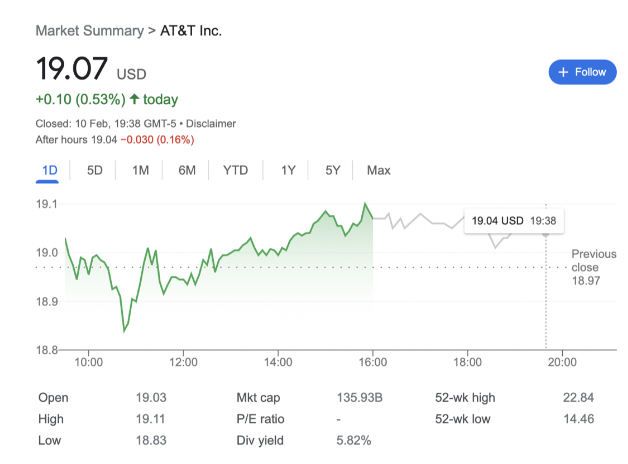

AT&T (T)

AT&T is a telecommunications company that provides a wide range of services, including phone, internet, and television. The company is well-positioned to weather inflationary pressures as it operates in a relatively stable industry and has a large and growing customer base. Additionally, AT&T has a significant market share and pricing power, which can help it to weather inflationary pressures.

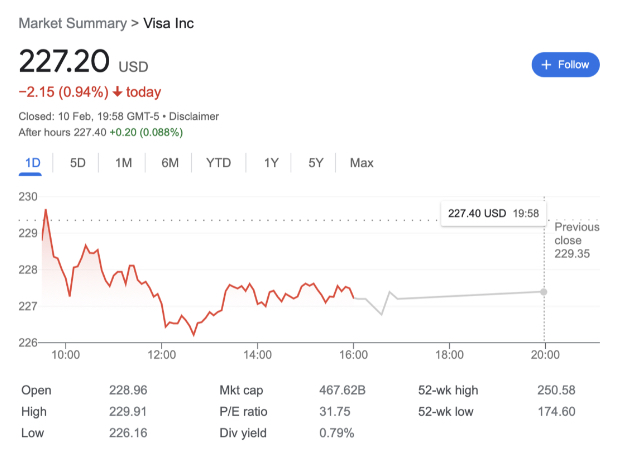

Visa (V)

Visa is a financial services company that provides payment processing services to consumers and businesses. The company is well-positioned to weather inflationary pressures, as it operates in a relatively stable industry with a large and growing customer base. Additionally, Visa has a significant market share and pricing power, which can help it to weather inflationary pressures.

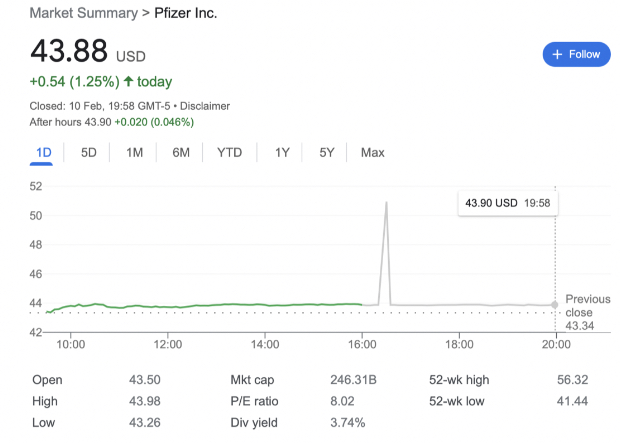

Pfizer (PFE)

Pfizer is a healthcare company that produces a wide range of products, including prescription drugs and vaccines. The company is well-positioned to weather inflationary pressures, as it operates in a relatively stable and growing industry and has a strong brand and reputation for quality. Additionally, Pfizer has pricing power, which can help it to weather inflationary pressures.

Verizon (VZ)

Verizon is a telecommunications company that provides a wide range of services, including phone, internet, and television. The company is well-positioned to weather inflationary pressures, as it operates in a relatively stable industry with a large and growing customer base. Additionally, Verizon has a significant market share and pricing power, which can help it to weather inflationary pressures.

3M (MMM)

3M is a manufacturing company that produces a wide range of products, including industrial, healthcare, and consumer goods. The company is well-positioned to weather inflationary pressures, as it operates in a relatively stable industry and has a strong brand and reputation for quality. Additionally, 3M has pricing power, which can help it to weather inflationary pressures.

Inflation can significantly impact the stock market, but not all stocks are equally affected. Companies in specific industries, such as healthcare, technology, and consumer goods, may be better positioned to weather inflationary pressures and provide solid returns for investors. The ten stocks listed above are just a few examples of companies well-positioned to survive inflationary pressures and offer solid returns to investors. As always, it is essential to research and carefully consider your investment goals and risk tolerance before investing in any stock.

If you’re unsure about the stock market and interested in learning more about gold IRAs and how they may fit into your overall retirement strategy, contact American Bullion today at 1-800-465-3472. We can provide the information and resources you need to make an informed decision about your future.

The post Best Stocks for Inflation first appeared on American Bullion.Original post here: Best Stocks for Inflation

No comments:

Post a Comment