Transitory inflation is a short-lived increase in the economy’s general price level of goods and services. It occurs when a temporary rise in demand for goods and services exceeds the economy’s capacity to produce them. This results in upward pressure on prices, causing inflation. Unlike persistent inflation, which persists over time and can have lasting economic consequences, transitory inflation is typically a temporary phenomenon that lasts for a short period, usually one to two years.

The most common causes of transitory inflation are sudden spikes in demand for goods and services during periods of rapid economic growth or unexpected disruptions to supply chains, such as natural disasters or labor strikes. In these cases, the temporary increase in prices is usually accompanied by a corresponding demand increase, which eventually allows the economy to return to its average level of inflation.

For example, supply chain issues can cause prices to rise. If the price levels increase for a relatively short period of time, the inflation is described as “transitory.”

For example, supply chain issues can cause prices to rise. If the price levels increase for a relatively short period of time, the inflation is described as “transitory.”

One of the critical features of transitory inflation is that it is usually seen as a positive development in the economy. This is because when prices rise, it is often a sign that the economy is growing and that consumers are confident and spending more. This increased demand can stimulate further economic activity and create jobs, leading to further growth.

However, if transitory inflation persists over a prolonged period, it can become persistent inflation, which can have negative economic consequences. Steady inflation can erode purchasing power, increase the cost of borrowing, and create uncertainty for businesses and consumers.

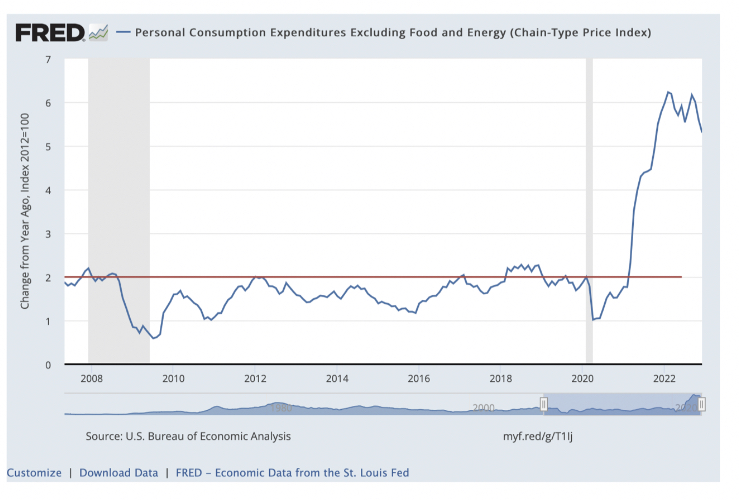

How Does Transitory Inflation Affect Monetary Policy?

Central banks use monetary policy to influence the overall level of inflation in the economy. The Federal Reserve, for example, uses tools such as interest rate adjustments and open market operations to control the money supply and, in turn, the level of inflation.

Central banks must determine whether the price rise is temporary or likely to persist when transitory inflation is present. If they believe that the inflation is transitory, they may take a wait-and-see approach, allowing the inflation to run its course without intervening.

However, if the central bank believes that transitory inflation is becoming persistent, it may take action to reduce inflation by raising interest rates or slowing the growth of the money supply. This action aims to reduce demand and curb price increases, helping to bring inflation back under control.

When Does Transitory Inflation Become Persistent?

Transitory inflation becomes persistent when it rises over a prolonged period, typically two years or more. Several factors, including a tight labor market, rising wages, and increased consumer spending, can drive this steady price rise.

If left unchecked, persistent inflation can negatively affect the economy, including decreased purchasing power, increased borrowing costs, and reduced economic growth. Therefore, it is essential for central banks to carefully monitor inflation levels and take action to prevent persistent inflation from taking hold.

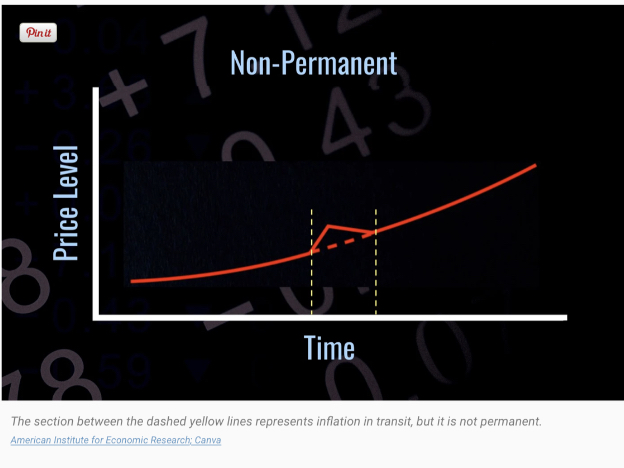

Graph Examples: Permanent and Non-Permanent Price Effects

One way to distinguish between transitory and persistent inflation is to examine their impact on prices over time. Transitory inflation has a temporary and limited impact on prices, while steady inflation has lasting and widespread effects.

To illustrate the difference, consider the following graph of a hypothetical economy. In this graph, the red line represents the general level of prices in the economy, while the yellow line represents the level of transitory inflation.

In this example, we can see that transitory inflation causes a temporary spike in prices but that prices eventually return to their normal level as the transitory inflation subsides. This is consistent with the definition of transitory inflation as a short-lived increase in the general price level.

In this example, we can see that transitory inflation causes a temporary spike in prices but that prices eventually return to their normal level as the transitory inflation subsides. This is consistent with the definition of transitory inflation as a short-lived increase in the general price level.

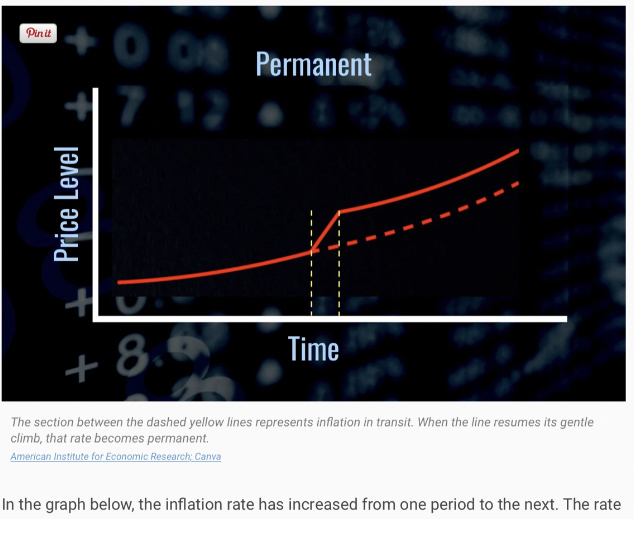

Now consider a second graph representing a hypothetical economy experiencing persistent inflation.

In this graph, the red line again represents the general level of prices in the economy, while the yellow line represents continuous inflation.

In this example, we can see that persistent inflation causes a steady and sustained price increase over time. Moreover, the level of prices continues to rise, even as the economy returns to normal, indicating that inflation is not transitory but is instead becoming persistent.

In this example, we can see that persistent inflation causes a steady and sustained price increase over time. Moreover, the level of prices continues to rise, even as the economy returns to normal, indicating that inflation is not transitory but is instead becoming persistent.

This distinction is essential for central banks, as it helps them determine whether to take action to reduce inflation or to allow it to run its course. For example, if the inflation is transitory, they may take a wait-and-see approach, while if the inflation is persistent, they may take action to reduce it.

Conclusion

Transitory inflation is a short-lived increase in the general price level of goods and services in an economy that occurs as a result of temporary spikes in demand or disruptions to supply chains. While transitory inflation is typically seen as a positive economic development, persistent inflation can have negative consequences, including decreased purchasing power, increased borrowing costs, and reduced economic growth.

Central banks use monetary policy to influence the overall level of inflation in the economy and must carefully monitor inflation levels to determine whether inflation is transitory or persistent. By distinguishing between transitory and steady inflation, central banks can make informed decisions about whether to take action to reduce inflation or to allow it to run its course.

If you’re interested in learning more about gold IRAs and how they may fit into your overall financial plan, contact American Bullion today at 1-800-465-3472. We can provide the information and resources you need to make an informed decision about your future.

The post What is Transitory Inflation? first appeared on American Bullion.Original post here: What is Transitory Inflation?

No comments:

Post a Comment