Gold has been a valuable and sought-after precious metal for centuries. It has been used as a store of value, a currency, and a hedge against inflation and economic uncertainty. Despite its fluctuating price, gold has always remained an attractive investment option.

Currently, the price of gold is rising, with many analysts predicting it could hit $3000 an ounce soon. The question remains, will gold hit $3000 an ounce?

In this article, we will delve into the intricacies of gold, the particular considerations surrounding its price, and the factors that could make it rise to $3000 an ounce. We will also explore when we can expect gold to reach this milestone and answer some frequently asked questions about the gold price. Finally, we will discuss why gold can be an essential asset to protect your financial future.

In this article, we will delve into the intricacies of gold, the particular considerations surrounding its price, and the factors that could make it rise to $3000 an ounce. We will also explore when we can expect gold to reach this milestone and answer some frequently asked questions about the gold price. Finally, we will discuss why gold can be an essential asset to protect your financial future.

Understanding Gold

Gold has been used as a store of value and a medium of exchange for thousands of years. Its value derives from its rarity and uses in various industries, such as jewelry, electronics, and aerospace. Unlike fiat currency, gold is not subject to inflation, meaning its purchasing power remains relatively stable over time. It is also a haven asset that investors turn to during economic uncertainty or geopolitical instability.

Gold is typically measured in troy ounces, with one troy ounce equal to 31.1 grams. The price of gold is determined by supply and demand factors, with most gold traded on international exchanges in gold futures contracts. These contracts allow investors to speculate on the price of gold without taking physical possession of the metal.

Gold has long been considered a haven asset and a store of value. It is a precious metal used for centuries as currency, jewelry, and investment. Gold has a unique set of properties that make it an attractive investment. It is rare, durable, and does not corrode or tarnish. It is also easily recognizable and has a high value-to-weight ratio. As a result, gold is used as a hedge against inflation, currency devaluation, and global uncertainty.

Gold has long been considered a haven asset and a store of value. It is a precious metal used for centuries as currency, jewelry, and investment. Gold has a unique set of properties that make it an attractive investment. It is rare, durable, and does not corrode or tarnish. It is also easily recognizable and has a high value-to-weight ratio. As a result, gold is used as a hedge against inflation, currency devaluation, and global uncertainty.

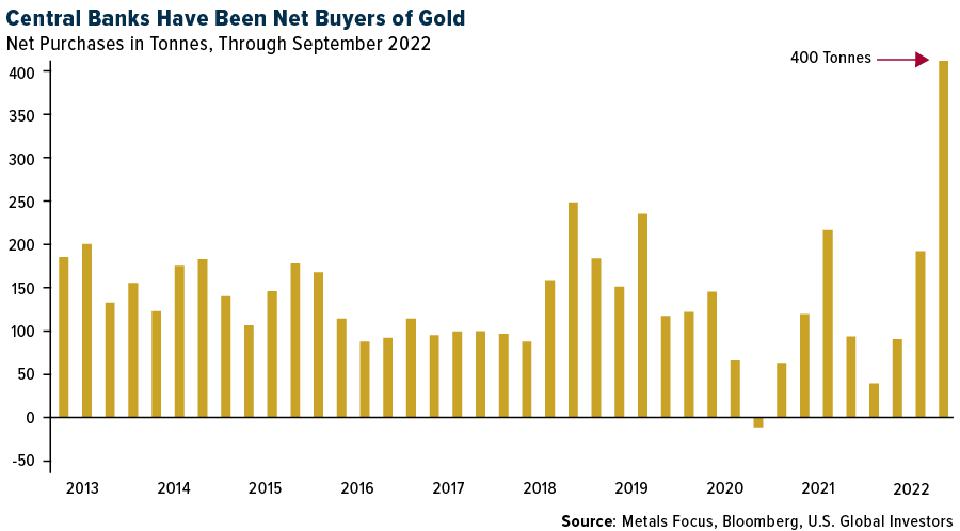

Supply and demand, economic and geopolitical factors, and monetary policy influence gold prices. Central banks are significant holders of gold, and their buying and selling can impact prices. However, the supply of gold is limited, and discoveries of gold are relatively rare. Therefore, the demand for gold can drive prices higher, especially during economic uncertainty.

Particular Considerations

Gold has always been a popular investment choice for people looking to protect their finances during economic downturns. It’s often seen as a safe-haven asset that can help investors weather financial storms. However, before investing in gold, there are particular considerations that you should take into account.

Firstly, the value of gold is subject to fluctuations, which means it can be volatile. Therefore, like any other investment, it’s essential to research and understand the factors that impact gold prices. Significant factors affecting gold prices include inflation rates, economic stability, political uncertainty, and interest rates.

Another consideration when investing in gold is the form you want to use. Gold investments can take many forms, including physical gold, gold ETFs, gold mutual funds, and gold mining stocks. Physical gold is the most tangible form of gold investment, but it requires safe storage and can be challenging to liquidate quickly.

On the other hand, gold ETFs and mutual funds offer exposure to the gold market without requiring physical ownership of gold. In addition, these investment vehicles are more liquid than physical gold and can be traded on the stock exchange, making it easy to buy and sell.

Lastly, investors should also consider the expenses involved in investing in gold. The costs of storing, insuring, and transporting gold can add up, so weighing the expenses against the potential gains is crucial.

What factors could make gold go up to $3000 an ounce?

Several factors could contribute to gold prices rising to $3000 an ounce. These factors include:

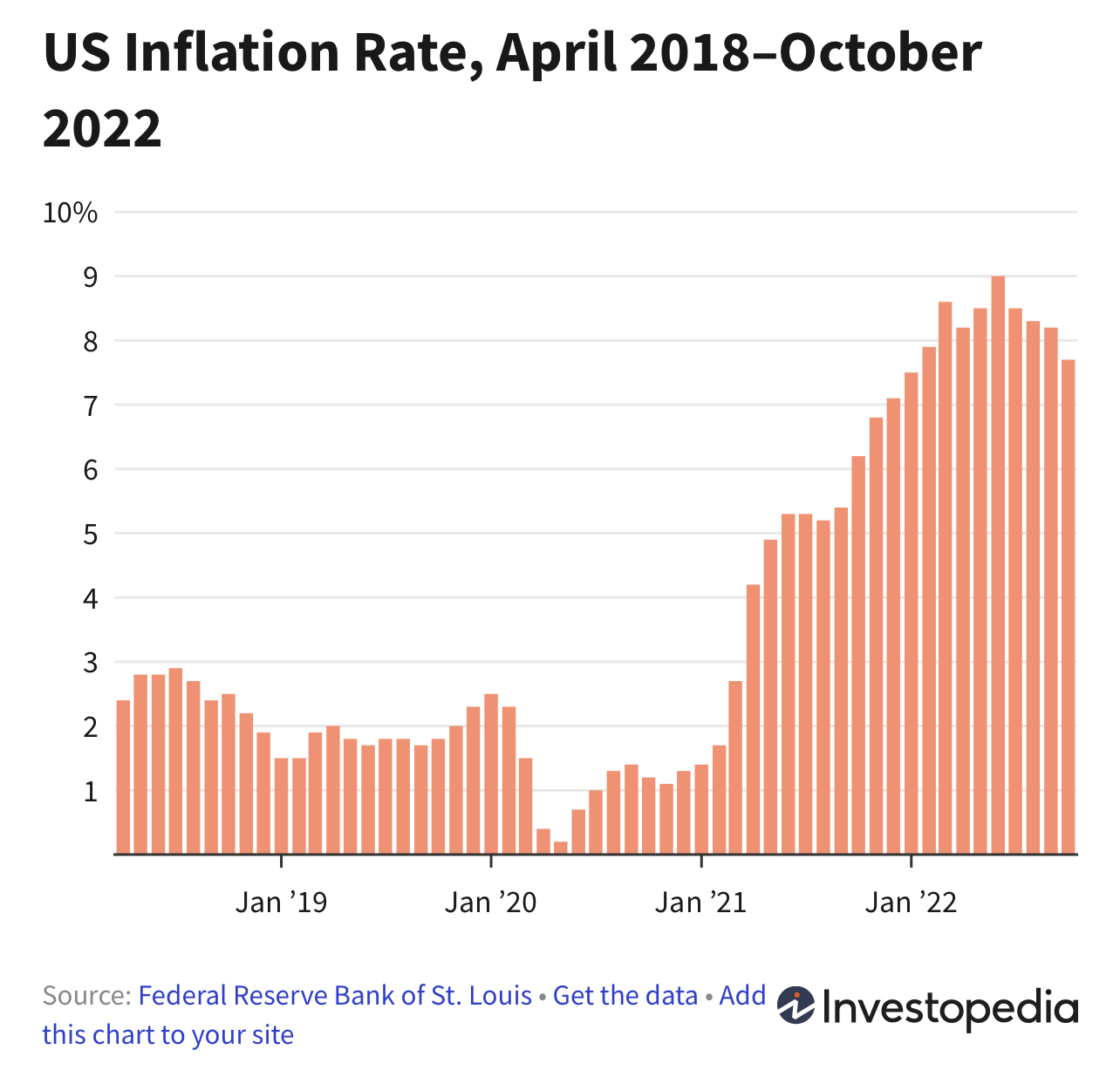

Inflation

Inflation is the rate at which prices for goods and services rise, eroding the value of a paper currency. Gold is often seen as a hedge against inflation, as its value tends to increase during inflation. If the current inflation rates continue to rise, gold prices could follow suit and reach the $3000 mark.

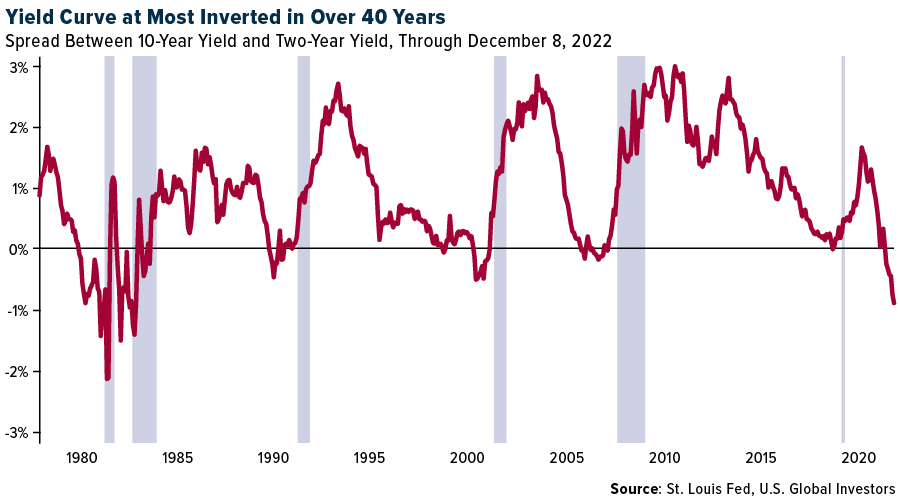

An indicator we keep our eyes on is the spread between the 10-year Treasury yield and two-year Treasury yield. Over the past 40 years (at least), every recession has been preceded by a yield curve inversion. As of today, the yield curve is at its most inverted in over 40 years, suggesting a recession is all but guaranteed. The question is not if, but when.

Economic Uncertainty

Economic Uncertainty

Economic uncertainty can cause investors to seek out safe-haven assets, and gold is often seen as one of these assets. The COVID-19 pandemic, its economic impact, and geopolitical tensions are some of the factors that have increased economic uncertainty globally. As a result, investors are turning to gold as a safe-haven asset, which could drive up demand and, in turn, push up gold prices.

Low-Interest Rates

Interest rates play a significant role in the price of gold. When interest rates are low, it reduces the opportunity cost of holding gold, making it more attractive to investors. The current global low-interest-rate environment is one reason gold prices have been rising. If interest rates remain low or decline, gold prices could be pushed toward $3000 an ounce.

Weakening US Dollar

The US dollar is often used as a benchmark for gold prices, and as the value of the dollar declines, gold prices tend to rise. However, the ongoing economic uncertainty and the massive fiscal and monetary stimulus measures introduced to support the economy have led to a weaker US dollar. This weakening of the US dollar is one of the significant reasons why gold prices have been rising, and if this trend continues, it could push gold prices toward the $3000 mark.

When Can Gold Hit $3000 an Ounce?

Given the current state of the economy, experts have varying opinions on when gold will hit $3000 an ounce. Some believe it may take a few years, while others predict it may happen sooner rather than later. Therefore, examining the economic factors influencing gold prices is essential to understand better when gold could reach this milestone.

One factor that could contribute to the rise of gold prices is the instability of the US dollar. In recent years, the US dollar has experienced a decline in value due to factors such as inflation, economic recession, and political turmoil. As a result, investors have turned to gold as a safe-haven asset, which has increased demand and driven up prices. Additionally, the US Federal Reserve has implemented monetary policies such as quantitative easing and low-interest rates, which have increased the money supply and devalued the dollar, making gold more attractive.

Another factor that could contribute to the rise in gold prices is geopolitical uncertainty. As tensions between nations rise and conflicts erupt, investors seek out safe-haven assets like gold. For example, in a major war or a global crisis, gold may experience a significant increase in demand, which could lead to higher prices.

Another factor that could contribute to the rise in gold prices is geopolitical uncertainty. As tensions between nations rise and conflicts erupt, investors seek out safe-haven assets like gold. For example, in a major war or a global crisis, gold may experience a significant increase in demand, which could lead to higher prices.

Frequently Asked Questions About Gold Price

What is the current price of gold?

The price of gold changes constantly due to market conditions and other economic factors. As of February 2023, gold hovers around $1,800 per ounce.

What factors influence the price of gold?

Several factors can influence the price of gold, including inflation, economic conditions, geopolitical uncertainty, central bank policies, and the value of the US dollar.

Is gold a good investment?

Gold is often considered a good investment for several reasons. First, it is a safe-haven asset that can hedge against inflation, economic instability, and political uncertainty. Additionally, gold can diversify a portfolio and has a low correlation with other asset classes.

Can gold prices go down?

Yes, gold prices can decrease due to changes in market conditions or other economic factors. However, gold has historically been a reliable store of value and tends to perform well over the long term.

Gold Can Protect Your Financial Future

With the current state of the economy and the uncertainty surrounding the future, investing in gold can protect your financial future. Gold has proven to be a reliable store of value and a safe-haven asset during economic instability and geopolitical turmoil. In addition, adding gold to your investment portfolio can diversify your assets and protect against inflation and currency devaluation.

Furthermore, investing in gold is relatively easy and accessible for investors of all levels. You can invest in gold through various means, including physical bullion, exchange-traded funds (ETFs), or mining stocks. Each option has advantages and disadvantages, and it is essential to research and consult a financial advisor to determine which option is best for you.

Conclusion

Whether gold will hit $3000 an ounce has been on the minds of investors and analysts for some time now. While there is no clear answer to this question, it is evident that various economic factors, including inflation, economic conditions, geopolitical uncertainty, and central bank policies, influence the price of gold.

However, by understanding these factors and keeping a close eye on the market, investors can make informed decisions and take advantage of the opportunities that arise. Moreover, with its long history as a reliable store of value and safe-haven asset, gold can provide protection and stability for investors seeking to secure their financial future.

Whether you are new to gold investing or have been a collector for years, it is essential to research and work with a reputable dealer. American Bullion is a trusted resource for those looking to invest in gold IRAs, offering a wide selection of gold coins from around the world and expert guidance on which coins are right for you.

So why wait? Invest in gold coins today with American Bullion and start building a brighter financial future.

The post Will Gold Hit $3,000 an Ounce? first appeared on American Bullion.Original post here: Will Gold Hit $3,000 an Ounce?

No comments:

Post a Comment